The Most Effective Countries for Offshore Investment and Their Financial Benefits

The Most Effective Countries for Offshore Investment and Their Financial Benefits

Blog Article

Exactly How Offshore Financial Investment Works: A Step-by-Step Breakdown for Investors

Offshore financial investment offers a structured pathway for investors looking for to optimize their economic approaches while leveraging worldwide possibilities - Offshore Investment. The procedure starts with the cautious option of a jurisdiction that lines up with a financier's goals, complied with by the establishment of an account with a legitimate offshore organization. This systematic approach not only permits portfolio diversification but also necessitates recurring management to browse the complexities of global markets. As we check out each action in information, it comes to be noticeable that understanding the subtleties of this financial investment method is vital for achieving ideal results.

Recognizing Offshore Investment

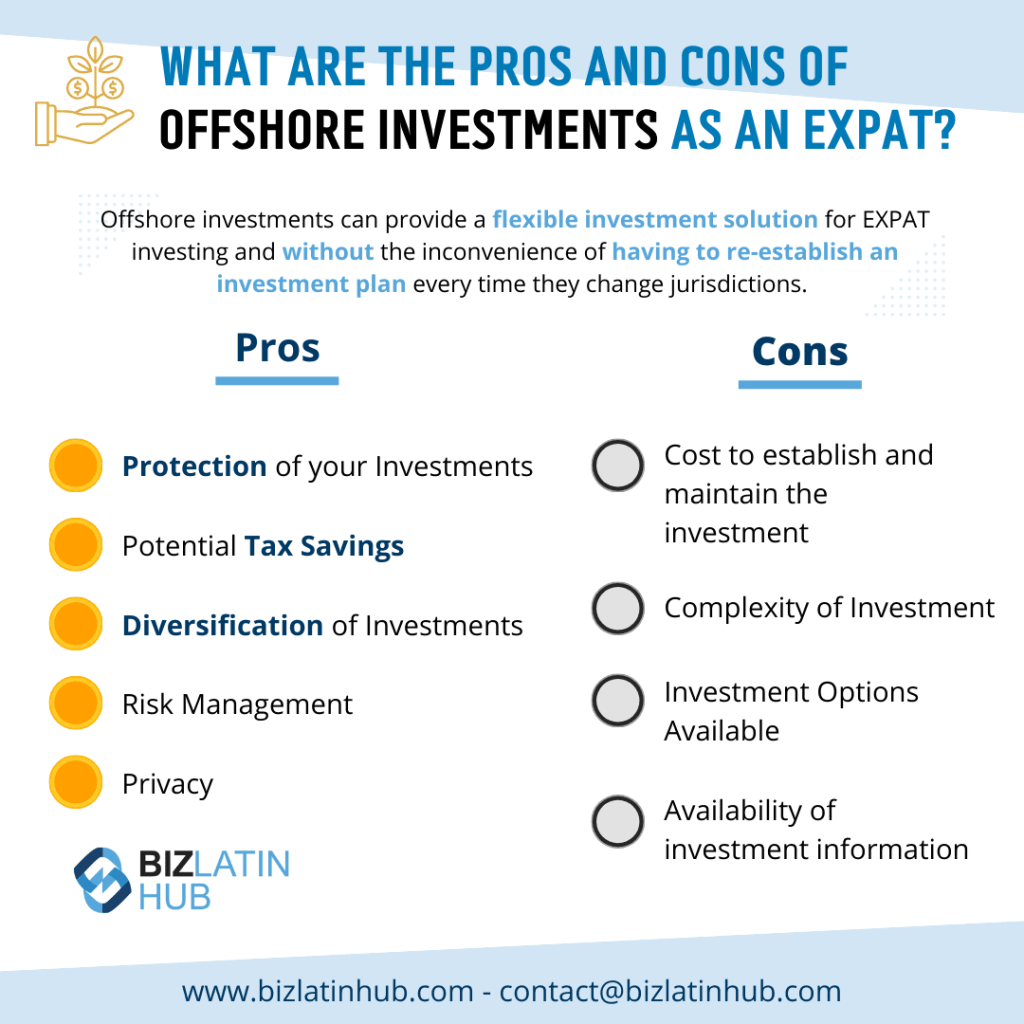

Comprehending offshore investment includes identifying the strategic advantages it supplies to people and corporations looking for to optimize their monetary portfolios. Offshore financial investments generally describe properties held in an international jurisdiction, frequently characterized by positive tax obligation regimens, governing settings, and personal privacy securities. The key objective behind such investments is to improve resources growth, risk, and diversification management.

Investors can access a broad selection of economic tools with offshore venues, including stocks, bonds, common funds, and property. These investments are frequently structured to adhere to local regulations while providing flexibility in regards to property allocation. Additionally, overseas financial investment approaches can make it possible for companies and people to hedge against residential market volatility and geopolitical risks.

Another key facet of offshore investment is the capacity for improved privacy. A thorough understanding of both the obligations and advantages associated with offshore investments is important for educated decision-making.

Advantages of Offshore Spending

Financiers typically transform to offshore spending for its numerous advantages, including tax performance, property protection, and portfolio diversification. Among the key advantages is the capacity for tax obligation optimization. Several overseas territories supply favorable tax obligation programs, allowing capitalists to legitimately lower their tax obligation liabilities and make the most of returns on their financial investments.

Additionally, overseas accounts can supply a layer of possession security. Offshore Investment. By positioning assets in politically steady territories with solid personal privacy legislations, investors can protect their wide range from possible lawful cases, lenders, or financial instability in their home countries. This form of security is specifically interesting high-net-worth individuals and entrepreneurs encountering lawsuits risks

Additionally, overseas investing assists in portfolio diversity. Accessing international markets permits financiers to explore possibilities in various asset courses, consisting of realty, stocks, and bonds, which might not be offered domestically. This diversity can minimize general portfolio threat and boost potential returns.

Eventually, the benefits of overseas investing are engaging for those looking for to optimize their economic techniques. It is vital for investors to completely recognize the effects and regulations connected with overseas financial investments to make certain compliance and attain their financial objectives.

Picking the Right Territory

Choosing the proper territory for offshore investing is a vital choice that can significantly affect an investor's monetary strategy. The appropriate jurisdiction can give different advantages, including favorable tax structures, asset protection laws, and governing atmospheres that line up with a financier's goals.

When choosing a territory, take into consideration aspects such as the political stability and economic health and wellness of the nation, as these aspects can affect financial investment security and returns. Additionally, the lawful structure bordering foreign financial investments ought to be assessed to guarantee compliance and defense of assets. Nations understood for durable lawful systems and transparency, like Singapore or Switzerland, usually instill better self-confidence amongst capitalists.

Additionally, assess the tax implications of the jurisdiction. Some countries supply eye-catching tax motivations, while others may enforce rigorous reporting requirements. Recognizing these subtleties can aid in enhancing tax obligation obligations.

Steps to Establish an Offshore Account

Developing an offshore account involves a collection of systematic steps that make certain compliance and protection. The very first step is selecting a trusted overseas financial establishment, which ought to be licensed and managed in its jurisdiction. Conduct detailed research to evaluate the institution's credibility, services offered, and customer evaluations.

Following, collect the essential paperwork, which generally consists of recognition, evidence of address, and information relating to the source of funds. Various jurisdictions might have differing requirements, so it is essential to verify what is required.

Once the documents is prepared, start the application process. This might include completing types online or in person, relying on the institution's procedures. Be planned for a due persistance procedure where the financial institution will validate your identity and assess any possible risks connected with your account.

After authorization, you will obtain your account details, enabling you to money your offshore account. It is a good idea to keep clear documents of all purchases and abide by tax guidelines in your house country. Establishing the account appropriately sets the structure for efficient overseas financial investment management in the future.

Managing and Monitoring Your Investments

When an overseas account is efficiently set up, the focus changes to handling and monitoring your you could check here investments successfully. This essential stage entails a systematic technique to ensure your assets align with your economic goals and run the risk of resistance.

Begin by developing a clear financial investment method that outlines your objectives, whether they are prime preservation, revenue generation, or growth. On a regular basis evaluate your portfolio's performance against these benchmarks to assess whether changes are needed. Using financial management tools and platforms can assist in real-time tracking of your investments, supplying understandings into market patterns and possession allocation.

Engaging with your offshore economic advisor is crucial. They can offer competence and assistance, assisting you browse complicated worldwide markets and regulative settings. Set up routine testimonials to discuss performance, assess market problems, and rectify your additional resources strategy as needed.

In addition, continue to be informed regarding geopolitical growths and financial indications that might affect your investments. This aggressive method allows you to respond without delay to altering conditions, guaranteeing your offshore profile continues to be robust and aligned with your investment goals. Ultimately, diligent administration and continuous tracking are crucial for making the most of the advantages of your overseas financial investment method.

Final Thought

In final thought, offshore investment uses a strategic opportunity for portfolio diversity and danger monitoring. By selecting an appropriate territory and involving with reliable economic establishments, investors can browse the intricacies of international markets efficiently. The organized technique described makes sure that investors are well-equipped to enhance returns while sticking to legal frameworks. Proceeded tracking and cooperation with economic consultants stay essential for preserving a nimble investment strategy in an ever-evolving global landscape.

Offshore financial investment offers a structured pathway for capitalists seeking to maximize their economic approaches while leveraging international chances.Recognizing overseas investment includes recognizing the critical advantages it uses to companies and individuals looking for to maximize their financial portfolios. Offshore investments commonly refer to assets held in a foreign jurisdiction, commonly identified by favorable tax obligation programs, regulative settings, and privacy protections. Additionally, offshore financial investment methods can make it possible for individuals and businesses to hedge against domestic market volatility and geopolitical threats.

Report this page